- Unwinding the Thread

- Posts

- Alts Won't be Alts Much Longer

Alts Won't be Alts Much Longer

It's time to rethink alternative investments

The phrase “Alternative Assets” is a bit of a misnomer. Discourse tends to emphasize their “alternative” nature, implying that these assets share very little with traditional investments and are a passing fad. For some niches, like Funko Pops or Meteorites, it appears valid — putting aside the fact that both categories have registered $100K sales and above-market ROI in recent years.

But Alternative Assets are not solely reserved for the fringe collectibles or untested new investment vehicles. As classically defined, commodities, real estate, and hedge funds all fall under the same umbrella.

Despite the implication implicit in the name, alternative assets need not be volatile, esoteric, or, frankly: weird. What truly makes an asset an alternative investment is its decoupling from the traditional market (stocks & bonds).

The Transcontinental Railroad is often cited as the very first alternative investment — long before the days of fractional NFTs and Pokémon cards. In order to connect the two coasts of the United States in one of the largest infrastructure projects of the 19th century, it was clear from the outset that enormous amounts of capital would be required.

The railroad was funded using a combination of public subsidy bonds and private mortgage bonds — essentially a crowdfunding campaign, allowing individuals to buy bonds directly tied to the construction of the railroad.

At the very least, alternative investments pre-date the Civil War in the US, and are surely even older. This means that this type of investment has been practiced by financiers for decades longer than nearly any current company has been listed on the NYSE.

Though this lengthy history does not seem to bolster the category’s legitimacy, likely due to the diversity and constant evolution of the types of assets. Regardless of the attitude or misguided definitions that tend to stick to alternatives, it has never slowed its march towards adoption.

ALTS -> MAINSTREAM (REITS / PENSIONS)

The characterization of alternative assets as a risky or unserious bet is most saliently debunked by the investment activity of pension funds — which invests heavily in alternatives despite their mandate to return promised benefits to their participants (requiring a more conservative strategy).

For decades, pensions were restricted from investing in any asset classes falling outside the status quo. That all changed in 1974 with the introduction of the Employee Retirement Income Security Act (ERISA). The main purpose of this legislation was to allow for a more diversified portfolio, especially alternative assets with limited correlation to the stock market.

Pensions were now allowed to invest in “riskier” assets, most notably REITS, which are found in over 60% of pension portfolios today.

By 2001, public pension funds had undergone a transformation, allocating 8% of their portfolio to alternative assets. 20 years later, that number has tripled to 24%.

This story has been repeated over and over again.

In 1974, “as a hedge against the then-raging United Kingdom inflation rate,” the British Rail pension fund began investing in fine art, acquiring over 2,400 pieces across seven years. Echoing a familiar pattern, many scoffed at this strategy, but British Rail would ultimately be vindicated.

Over the next 22 years, the fund sold off works for a profit, ending in 1996 with a final mark of a 13.1% return per year.

At the beginning of this daring experiment, nobody could have guessed that the fund manager would regret being overly conservative. Yet, that’s exactly how the WallStreet Journal described the short-comings of the otherwise spectacularly performing fund.

“The pension fund's biggest mistake was that it was too conservative. It didn't take a flier at all in three fields that had spectacular run-ups in the last quarter-century: modern art, contemporary art and collectibles.”

The most high profile and impactful example of institutional adoption of alternative investment classes is found at a place not exactly known for its desire to buck the status quo: Yale.

In 1985, David Swensen took over as Yale’s Chief Investment Officer. When Swensen started implementing his now famous investment strategies, around 75% of Yale’s $1.3B endowment was invested in public equities.

Swensen lifted his gaze beyond the traditional model and sought higher yields in alternative investment classes like private equity, hedge funds, and real estate — creating a modernized portfolio that made him into an icon.

In his view, the long time horizon of the fund was an advantage — a reason to take more risks rather than play it down the middle.

In 2021, the New York Times described Swenson in the opening lines of his obituary as “a money manager who gave up a lucrative Wall Street career to oversee Yale University’s endowment and proceeded to revolutionize endowment investing, in the process making Yale’s the best-performing fund in the country over a 20-year period.”

LOW CORRELATION

But what is it exactly about this class of assets that positions it so well as a counterweight to the traditional market?

Gold is perhaps the most popular example of a low-correlation alternative asset. Not only is it uncorrelated to the market, but often gold is actually negatively correlated — meaning that in times of economic downturn, the value of gold rises.

With respect to gold, this phenomenon can be explained by a number of factors, headlined by its low volatility, which makes it an attractive place for investors to park funds during recessionary periods or otherwise unpredictable macro conditions.

The vast majority of demand for gold comes a combination of the manufacturing of luxury goods such as jewelery and its use as an investment vehicle.

There’s a relatively inelastic demand for high-end luxury goods like gold jewelery — as wealthy individuals are the most likely to purchase such products and are less likely to be forced to adapt their spending habits in response to a bear market.

Similarly, demand spikes for gold as an investment during economic downturns as a result of its historically consistent, low volatility returns.

The iShares Gold Trust, a fund launched to generally reflect the “performance of the price of gold,” has exhibited a correlation coefficient of just .07 compared to SPY.

Utilizing low-correlation investments like gold has become a popular practice among wealth managers and investors. It’s diversification by another name, translating into higher risk-adjusted returns when included in a well-optimized portfolio.

Additionally, gold has long been considered the ultimate inflation hedge for many of the same reasons listed above.

According to Seeking Alpha, an analysis of data from 1970 to 2021 shows that gold has produced a price appreciation of over 8% CAGR, more than 4% better than inflation.

ROI

But alternative assets are not just a diversification instrument, in many cases they have produced out-sized returns — running circles around the S&P 500.

The PWCC 100 Index, which tracks the performance of the vintage sports card market using a dynamic basket of investment grade cards, has returned 1,295% since January 2008. During that same time period, the S&P returned 175%.

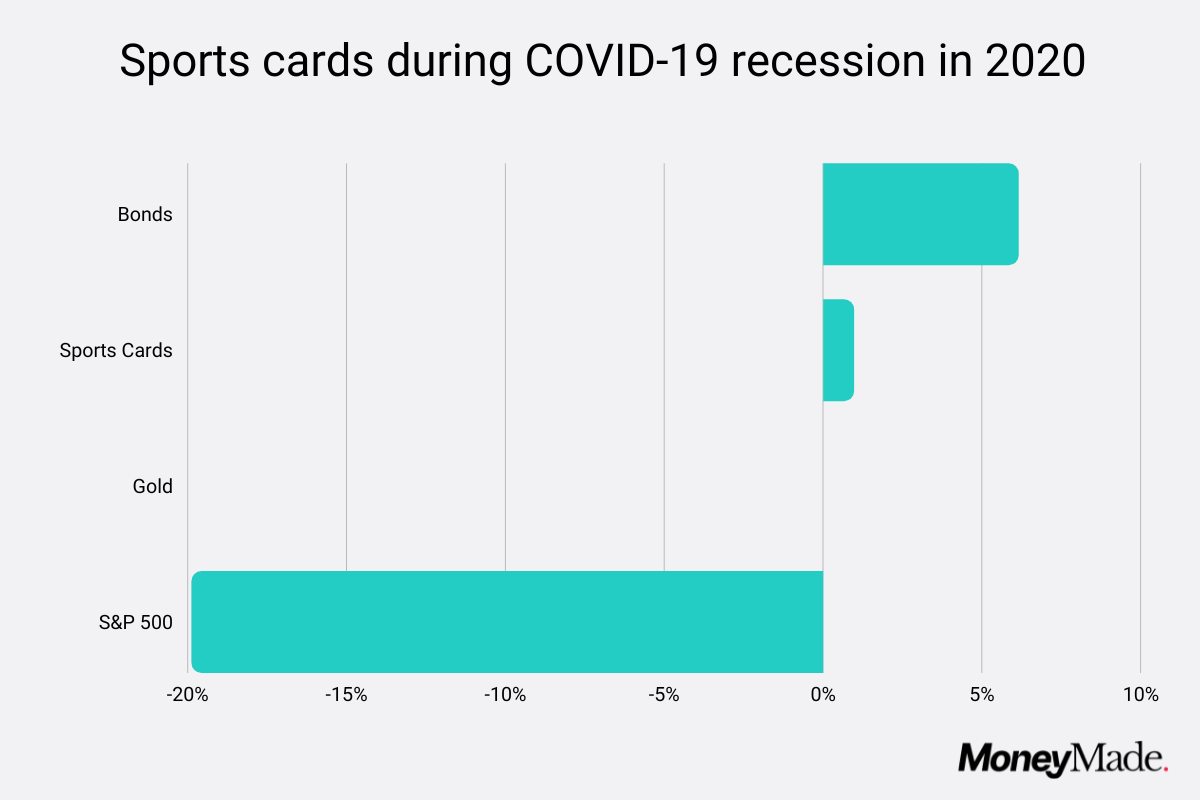

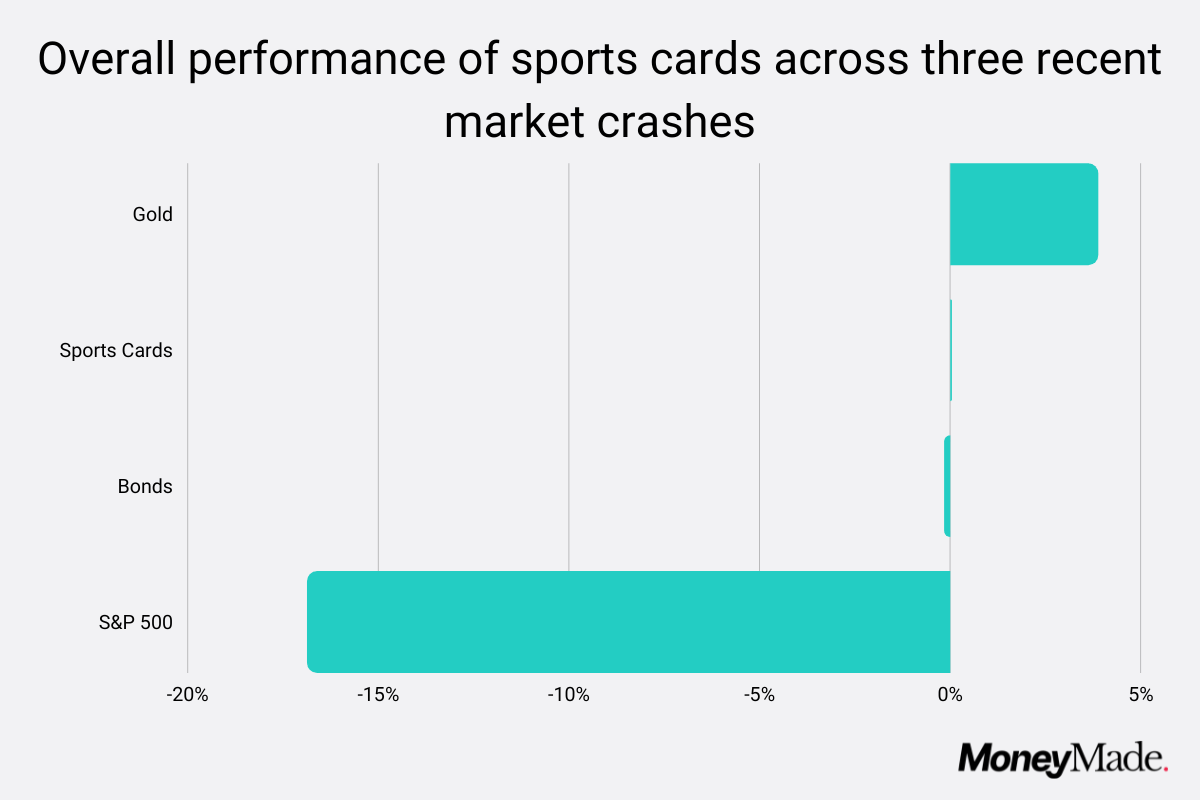

In a report from MoneyMade.io in collaboration with PWCC, the performance of sports cards was shown to be quite strong during difficult market conditions, highlighted by the charts included below.

Many other alternative asset classes tell a similar story, including wine.

Using data from the multiple indices compiled by Liv-ex, tracking the market for fine wine using a diverse range of components, its clear that the market for ultra expensive wine has proved to not only be a steady source of ROI, but also a relatively uncorrelated market from the overall economy.

Over the past 10 years, fine wine has returned 127% per year on average according to Knight Frank. Wine investors also point to demographic tailwinds showing a drastic shift in the average age of fine wine bidders from 65 in 1990 to 40 today.

CASH INFLUX

2021 was a blockbuster year for the art market.

Coming out of the pandemic, aggregate sales of art and antiques by dealers and auction houses cleared $65B, a 29% YoY. The market also surpassed pre-pandemic numbers, exhibiting a strong bounce-back as a reaction to macro conditions.

Leading the way in the art market in 2021 were the massive auction results — clocking in at a 47% YoY increase.

Similar to the significant demand for gold generated by the wealthy, high networth individuals have long fueled the blue chip art market.

Over a third of high networth individuals have spent over $1M on art and antique — representing a 20% YoY increase from 2020 and doubling the 2019 mark. The rise of NFTs played a major role in this rise in expenditures, with 11% of that spending going towards digital art.

COVID AS A CATALYST

There have been plenty of “Covid accelerated the industry ten years in ten months” analyses in the past year, across sectors from hospitality to tech.

But to glide past this moment in time as a game-changer in the history of alternative investments would be obfuscating a crucial part of the picture.

It’s no secret that during the Covid-19 pandemic, the Fed printed a ton of money — injecting ~$1.5T into the economy in the form of three waves of stimulus checks beginning in April 2020.

The result? The best year for income in American history.

Morgan Housel of the Collaborative Fund used the following three charts to illustrate the disconnect between the uncertain macro conditions and the surprising health of the average person’s earnings.

Housel pushes back against the notion that this record year should be treatest as an outlier due to the stimulus packages. Americans took in $1T more from March-November 2020 than the same time period over the previous year. But it is because of this fact rather than in spite of it that Housel believes we have entered a new normal.

“A lot of the stimulus measures that took place in 2008 and 2020 – from industry bailouts to tax cuts to $1,200 checks – were things most people didn’t think were even possible before they happened. You might give your senator a pass for doing nothing if you think nothing is possible.

But now people know these things are possible, so they have a new set of expectations. No politician can look at unemployed Americans and say, “There’s nothing we can do.” They can only say, “We’re choosing not to do it.” Which few politicians – on either side – want to say when people are losing jobs.

So they stopped saying it.”

These unprecedented income levels fed directly into Housel’s second chart, showing that much of this money was used to pay off debt — a trend that resulted in credit card balances shrinking by over $100B.

Housel explains that mortgage refinancings doubled YoY, “locking in interest rates that would have seemed like a joke a few years ago.”

Lastly, student debt is rising at the slowest rate in over a decade. All of this has led to an absolutely unparalleled surge in the value of American checking accounts. Not to mention the recent cancellation of partial student debt by the Biden Administration.

With the emergence of these unprecedented economic conditions all at once — namely a world in which record income coexists with existential threats to macro environments — an entirely new chapter of behavioral economics was written.

Not only did Americans have record savings and discretionary savings, but the basket of goods available to them shrank drastically as a result of Covid lockdowns. Combined with months spent indoors, where many found community on the internet, investing habits were forever altered.

CHANGING TIDES

The first signs of the next generation of retail investors became apparent during the GameStop saga, in which a group of young anti-establishment traders from a subreddit called r/wallstreetbets took aim at Wall Street — managing to liquidate untold millions in short positions before running out of steam.

It’s important reflect on this movement as a harbinger of things to come for alternative investing. Not because they share similar motivations —if one were to parse out a singular motivation for the r/wallstreetbets movement, it would be the thrill of gambling and/or belonging to a community.

That is not the case for the adoption of alternative assets.

But what the two do share is the willingness to take on perceived risk. While the primary driver for meme stock investing is a risk itself, the promise of fortune and/or ruin (both of which can be commodified in the form of social media clout), the driving force behind alternative asset investors is the belief that they are making the most of an arbitrage opportunity — represented by the gulf between perceived risk and actual risk.